NOTE: This article relies heavily on concepts found in the author’s articles

entitled “Multi-Stage Equity Stripping”,

“Laying a Trap to Make a Judgment Creditor Cry ‘Uncle!’”,

“Entanglement Theory®”, and

“Using Offshore LLCs for Advanced Structuring of Management Companies.”

It is a widely known statistic that approximately half of all marriages in the United States fail. Nonetheless, most people see marriage as desirable. For high net-worth individuals who marry, the potential destruction of one’s wealth in the event of divorce is a serious concern. Therefore, many such individuals are interested in a special type of asset protection, known as Pre-Marital/Pre-Divorce planning (PD/PM planning), as a means to minimize the hazards of a marriage gone bad.

Before we discuss PD/PM planning, we should discuss what it is not. PD/PM planning is not a means to avoid child-support payments. It will also not bar 100% of your assets from spousal attachment. Rather, PD/PM planning is a means to ensure that most of the assets you had before you married will either remain yours or revert to your ownership within 1 or 2 years of the divorce being final.

The Pre-Nuptial Agreement

The fairest and most honest way to work out the division of assets between spouses in the event of divorce is through a pre-nuptial (or sometimes post-nuptial) agreement. Many will argue that such an agreement casts a shadow on the marriage, is unromantic, and shows one’s pessimism towards the possibility of a happy marriage in general. However, in the event of a divorce, a pre-nuptial agreement will reduce the emotional pain, bitterness, and cost of divorce. This is because a pre-nuptial agreement will clarify many issues that may otherwise be brutal battlegrounds in a divorce proceeding. Furthermore, a pre-nuptial agreement may clarify certain terms and expectations of the marriage itself. This helps avoid misunderstandings and misconceptions that might otherwise cause marital conflict.

Notwithstanding the usefulness of a pre-nuptial agreement, the author has had many clients whose spouse-to-be was not willing to sign an agreement (or the client was unwilling to even approach their fiancée about an agreement.) Nonetheless, the client wanted to make sure that, if the marriage ended in divorce, s/he would not lose everything that s/he had worked so hard to acquire. This is where asset protection planning and PD/PM planning coincide.

The Fundamentals of PD/PM Asset Protection Planning

Pre- and post-nuptial agreements aside, there is one fundamental strategy we use in PD/PM planning, known as the Trojan Horse Method®. The Trojan Horse Method® involves placing assets out of the ex-spouse’s reach. Then, in divorce proceedings, we offer an attractive “gift” to the ex-spouse, which in actuality is a carefully laid trap, or Trojan Horse. In a nutshell, this is accomplished when we place assets in certain Charging Order Protected Entities (COPEs)[1] and, if divorce seems likely, management of the COPEs are shifted away from the client and out of U.S. jurisdiction. Subsequently, although the ex-spouse may receive a sizeable or even near-complete ownership of the entities, s/he will not have any control or access to their assets. We can then either stalemate the spouse into a favorable settlement (where the ex-spouse receives a smaller share of assets than s/he would otherwise receive, in exchange for his entities’ interests that are essentially worthless) or, we can make sure that, although s/he receives no entity profits, s/he receives all the tax liability from such profits.[2] Optimally, the ex-spouse will receive a sizeable tax liability from the entity(s), but s/he won’t receive any funds to pay the tax. We are essentially placing the ex-spouse in a financial vice-grip until s/he cries “uncle!” At that point, we offer to buy the company interest back, pay for the tax liability, and offer a much smaller settlement than the ex-spouse would otherwise have received.

Why is the Trojan Horse Method® More Effective Than Other Pre-Divorce Planning Strategies?

Besides the Trojan Horse Method®, there are two other less effective PD/PM strategies that are often utilized:

- The most common method is for one spouse to transfer assets out of his name and hide them from the other spouse. Practically all divorce attorneys are aware of this tactic, and have subsequently found effective ways to discover hidden assets.

- A more effective strategy is to shift assets offshore. These assets will then be outside of the divorce court’s jurisdiction. While this technique can be effective, the court will usually counter this approach by giving the ex-spouse a greater portion of remaining onshore assets to compensate for the offshore assets outside court jurisdiction. Because it is usually difficult to shift all of one’s assets offshore, the divorce court may be able to effectively counter this strategy.

The Trojan Horse Method® is more effective than the above strategies because it allows the client to appear to be cooperating with the court in dividing marital assets. This means that neither the spouse nor the court will likely suspect any PD/PM plan is in place, and therefore the court will likely not see any reason to give more onshore assets to the ex-spouse. Indeed, if for example the client’s assets are in COPEs that are not managed by him, then all s/he can do is give up his membership interest in the entities. However, because the entities are solely managed by a friendly 3rd party[3], both the client and court are unable to compel entity profit and/or asset distributions to the ex-spouse. Furthermore, although management should be offshore immediately before and during divorce proceedings, assets may be held in domestic entities (if the plan is implemented more than 1 year before the divorce’s initiation[4]), which are less suspicious to a U.S. judge and therefore also less likely to invoke him to give more of the client’s onshore assets to the ex-spouse. Finally, because the Trojan Horse Method® anticipates giving at least half of an entity’s ownership interest to an ex-spouse, the Method is equally effective in community property and non-community property states.

An Illustration and Explanation of the Trojan Horse Method®

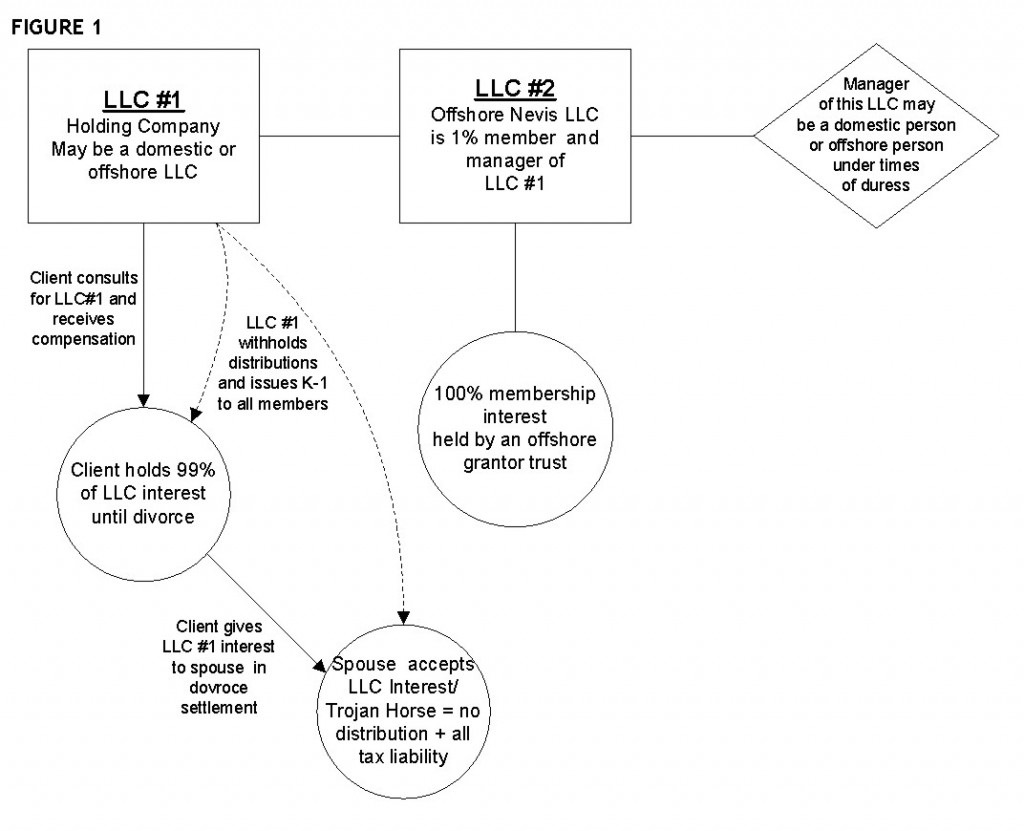

Figure 1, below, gives a more detailed illustration of how the Trojan Horse Method® is implemented. First, as many assets as possible are placed in domestic or offshore COPEs (in this illustration, all such entities are collectively referred to as “LLC #1”.) Although it may not always be feasible to hold mortgaged real estate or one’s home in LLC #1, these assets may be effectively shielded via an equity stripping program, wherein LLC #1 would hold the majority of the real properties’ equity in the form of un-trapped equity/liquid assets.[5]

Second, an offshore LLC (LLC #2) is formed, which holds a 1% interest and all management powers in LLC #1. The manager of LLC #2 may, in turn, be the client or a trusted domestic 3rd party while the marital seas are calm, although the management should be shifted offshore at the first sign that a divorce may be pending. The membership interest of LLC #2 should be held by an offshore grantor trust (such as a Purpose Trust, which is essentially a trust with no beneficiaries) so that LLC #2 is completely independent of the client.

If divorce proceedings commence, the negotiation regarding division of marital assets begins. At this point, the client’s attorney should offer at least half of the client’s interest in LLC #1 to his spouse. Since this is the only thing the client has to give (in connection with LLC #1) such an offer makes sense and will be welcomed by his spouse. The client could possibly even offer all of his interest in LLC #1 if his spouse was willing to make other concessions (custody of or favorable visiting rights with the couple’s children, for example.) Every effort should be made to make the divorce as quick and painless as possible. Once the division of assets is finalized, the bait has been taken and the trap is set. At this point, the client merely has to wait until the end of the taxable year. In the meantime, no distributions are made from LLC #1, although the client may draw funds from the company by rendering consulting services to it in exchange for monetary compensation. Soon after the end of the tax year, LLC #1 will distribute a K-1 to each member. A K-1 is a report given to each LLC member and the IRS stating the tax liability of each member for company gains and losses. Assuming there has been company profit (which can be ensured through conservative investing), the client’s ex-spouse will essentially receive a tax bill. However, since no distributions have been made to either party to pay for the tax debt, the spouse will now have a tax liability without the means to pay it (at least from LLC #1.) The client is now in an extremely advantageous position to negotiate a pennies-on-the-dollar buy-back of the spouse’s LLC #1 membership interest in return for alleviating of his surprise tax burden.

Implementing the Trojan Horse Method® After Threat of Divorce Has Materialized

Timing is always a factor when implementing an asset protection program. Ideally the program should be set up before any creditor threat arises (including divorce.) However, some clients fail to set up a program until the need to do so has already materialized. At this point, any transfer of assets to an onshore entity would be vulnerable to a fraudulent transfer ruling, which would cause the program to fail. The solution to this problem is to transfer assets to an offshore LLC (LLC #1 in Figure 1), or to an onshore LLC that is subsequently re-domiciled offshore by the LLC’s manager. Although transferring assets offshore may trigger extra reporting requirements and possibly even additional tax liability, plus greater expense when structuring the Trojan Horse, the offshore manager and LLC #1 would not be subject to a U.S. court order and therefore a domestic fraudulent transfer ruling would be an ineffective remedy against the transfer. It must also be noted that any PM/PD planning should be done under the supervision of an attorney, especially when divorce is already pending, so that attorney/client privilege may attach to the program for an extra layer of privacy.

[1] COPEs are Limited Liability Companies (LLCs) and Limited Partnerships (LPs). See page 1 of the author’s article Laying a Trap to Make a Judgment Creditor Cry “Uncle!” for more information on COPEs.

[2] See Laying a Trap to Make a Judgment Creditor Cry “Uncle!” and IRS Rev. Rul. 77-137 for more information on why such a strategy is feasible.

[3] Ideally, the 3rd party manager should not be an “insider” of the client per the U.F.T.A. See §§1(1) and 1(7) of the U.F.T.A. for its definition of an insider.

[4] The plan should also be implemented under an attorney’s supervision, so that attorney/client privilege attaches to the entire arrangement.

[5] See the author’s article Multi-Stage Equity Stripping: The Solution to Traditional Equity-Stripping Shortcomings for more information on multi-stage equity stripping.